- #DOES BITPAY REPORT TO IRS UPDATE#

- #DOES BITPAY REPORT TO IRS REGISTRATION#

- #DOES BITPAY REPORT TO IRS SOFTWARE#

The exchange rate has since retreated from that peak, falling to around $300 in early October 2014. As its fame increased and speculators began to invest, the price increased dramatically, reaching a high of $1,162 on November 30, 2013. In the early days of the virtual currency, it was worth on a few cents. dollar has fluctuated dramatically over time. The price of a bitcoin relative to the U.S. Once written to the block chain, the transaction is not reversible.

The whole process takes a couple of minutes maximum.

#DOES BITPAY REPORT TO IRS UPDATE#

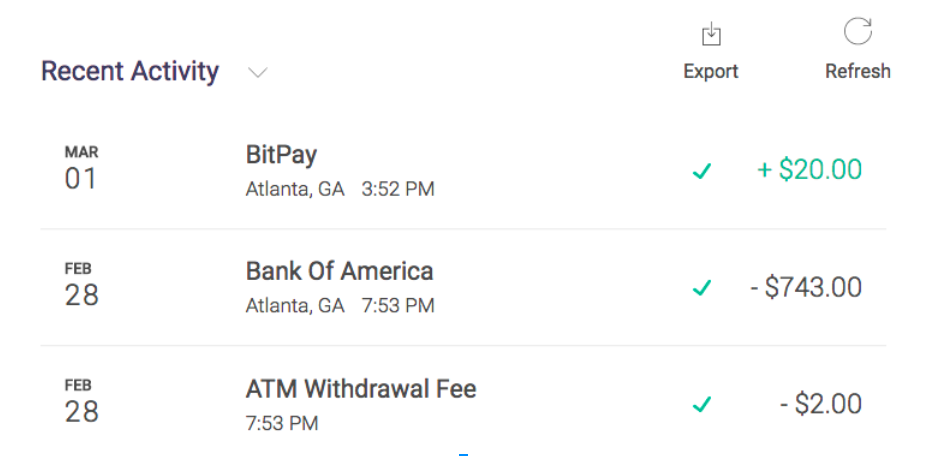

The miners perform the mathematic calculations necessary to verify the transaction, and if it is deemed authentic, update the block chain to indicate the transfer of ownership. To make a payment, a person uses his or her cryptographic credentials to sign a transaction transferring some amount of bitcoin to another person and submits it to the block chain. Bitcoin users, and merchants in particular, should assume that their bitcoin transactions are public knowledge. Tying a particular public key to an individual or company may be difficult, but it can be done. While bitcoin is sometimes described as an anonymous currency, every transaction is recorded in the publicly accessible block chain and is associated with a public key.

#DOES BITPAY REPORT TO IRS SOFTWARE#

That software may be located on a personal computer or smartphone or hosted in the cloud by a service provider. Because keeping track of these large numbers can be cumbersome, users typically employ a special piece of software called a “wallet” to manage their public and private keys. The public key is cryptographically associated with another large number, the “private key” which the user keeps confidential and uses to mathematically sign transactions. This is how new units of the virtual currency come into existence.īitcoin users are identified by their “public key” which is essentially a very large number. The entities which provide the hardware and software to host the database and authenticate transactions are called “miners” and they are periodically rewarded for their public service by being given a few bitcoins. The authenticity of any particular bitcoin may be verified by consulting a master database of bitcoins (called the “block chain”) which is maintained over a peer-to-peer network on the Internet. A bitcoin only has value because other participants in the ecosystem ascribe value to it. It is not issued by or redeemable at any financial institution. It is not backed by any government and is not legal tender in any jurisdiction. A bitcoin has no physical presence and no central authority administers the currency.

It is often classified as a “cryptocurrency” because it relies on cryptography to authenticate transactions.

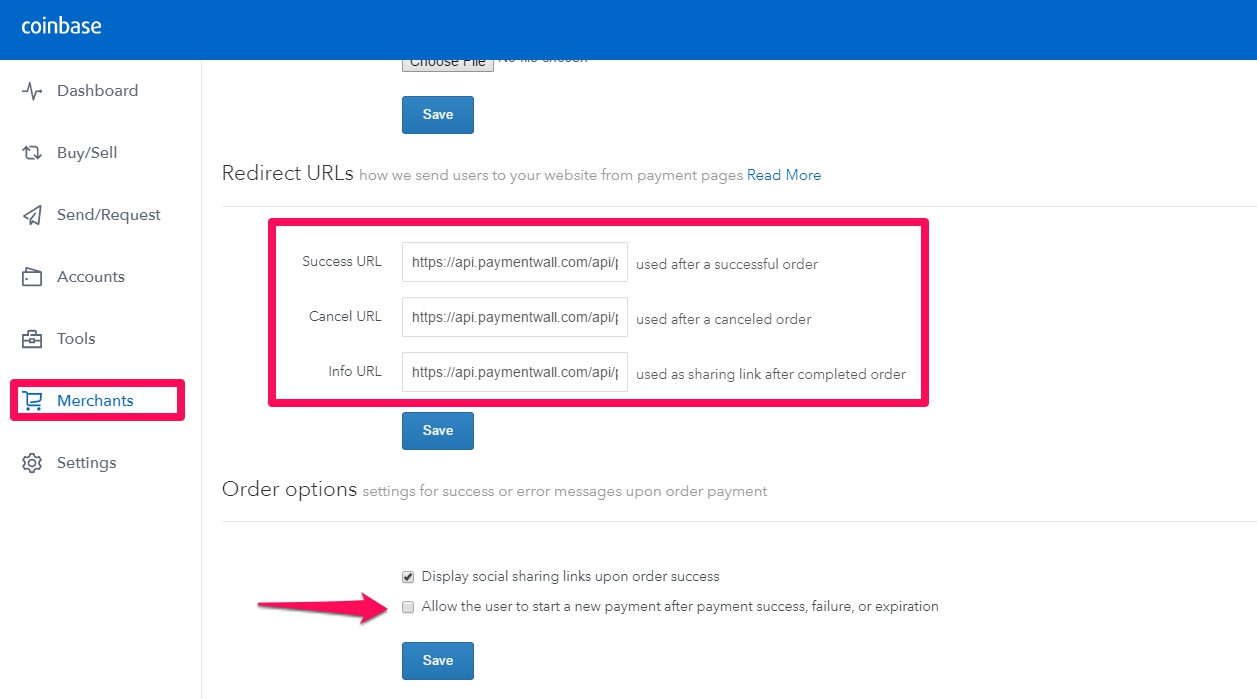

The BMSPs provide a range of services including accepting bitcoin and paying the merchant in dollars, removing many of the barriers to accepting this new payment mechanism.īitcoin is an Internet-based virtual currency which can be used to transfer value between parties. This article also discusses the use of bitcoin merchant service providers (BMSPs), which act as intermediaries between a business and a customer wishing to pay in bitcoin.

#DOES BITPAY REPORT TO IRS REGISTRATION#

It provides a brief overview of bitcoin, addresses potential registration and licensing issues, and examines the tax implications of accepting the virtual currency. This article examines the legal risks and issues that a business should evaluate before accepting bitcoin as a form of payment. Even the United Way now accepts donations in bitcoin. Nationally known merchants such as Dell, Expedia, and have jumped on the bitcoin band wagon, along with a number of smaller companies such as the New Mexico Tea Company and Grass Hill Alpacas. While its user base is still quite small compared to that of checks, credit and debit cards, and electronic funds transfers, a growing number of businesses are adopting bitcoin as a payment option for those customers who wish to use it. It has garnered a lot of attention among technocrats and has also been written about extensively in the popular press. Bitcoin is a so-called “cryptocurrency” that can be used as a medium of exchange to make payments and facilitate consumer and business transactions – primarily over the Internet.

0 kommentar(er)

0 kommentar(er)